North Stars

A vibrant community of members 60 years and older doing life together. Their motto is to do “what you can,” (Romans 12:6) “when you can,” (Galatians 6:10) “the best you can,” (Eccl. 9:10) to honor Christ and his Church.

North Stars gather monthly for shared meals, game luncheons, and meaningful connections. This group provides support, encouragement, and plenty of laughter as they navigate life’s unique challenges and joys together. Come join the fun and be part of this amazing community!

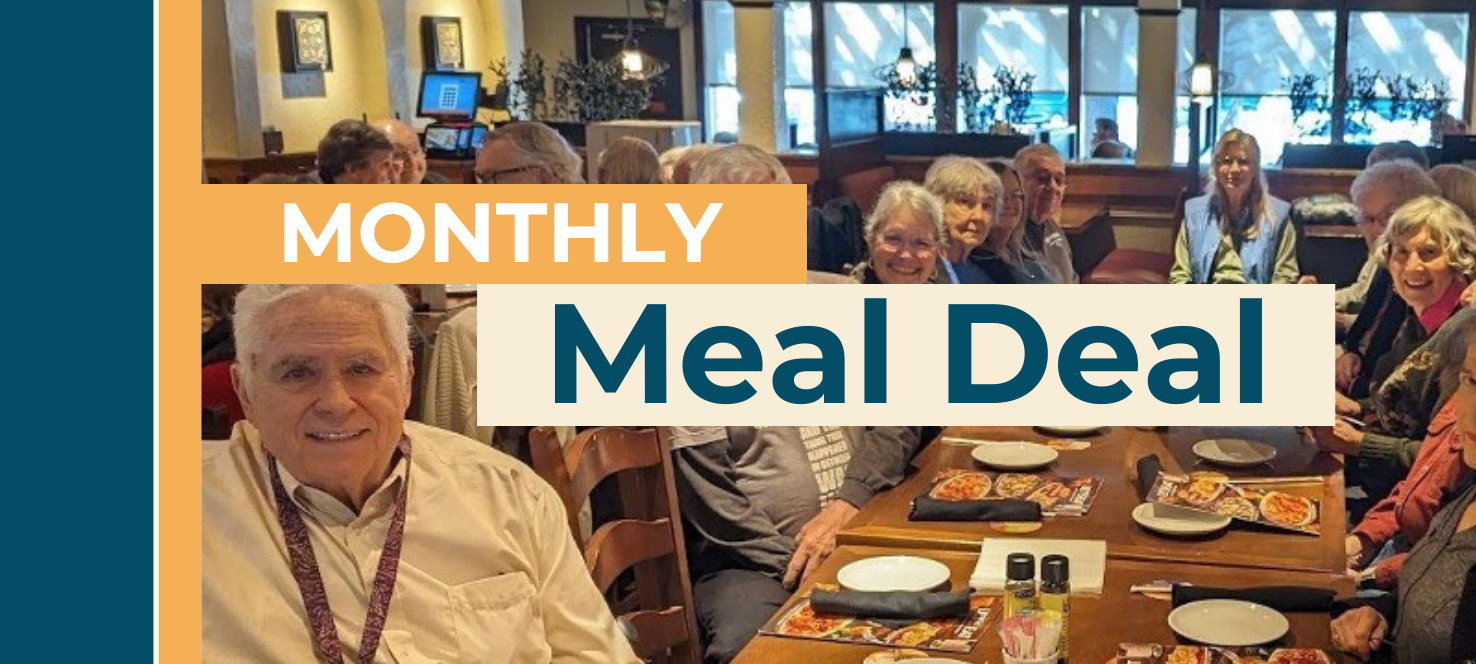

Monthly Meal Deal

Monthly Meal Deals are every second Friday of the month at 11:30 a.m. at a nearby restaurant. Click Learn More for details.

Game Day Lunch

Join us for games and fellowship on the fourth Friday of each month, starting at 11:30 a.m. in Room 238. Click Learn More for details.

Read about our Priorities and Goals

Bible Studies

Weekly Bible studies for women and men are offered on Tuesdays at 10 a.m. Click the buttons for details!

In case you missed it...

On October 24, we enjoyed a special presentation by Esse Moreno, who informed us about Medicare, Medicare Supplements, and other insurance often purchased to cover vision, hearing, and dental care. We heard about first-time enrollment, reviewing coverages annually during the open enrollment period, the benefit levels of the various Medicare Supplement Plans, and more. If you were unable to attend, or you would like to view it again, check out the recording below.

News You May Not Be Aware Of

United States Postal Service Rule Changes

Did you know that on December 24, 2025, the United States Postal Service changed their rules on the way post marks are applied to mail?

Required Minimum Distribution (RMD) Reminder

Year-end 2025 is the time you will need to determine the amount of your Required Minimum Distribution (RMDs) for certain of your retirement savings account for 2026. You will want to learn how frequent mistakes are made and how to avoid penalties for failing to take the full RMD.

Medicare and Social Security Revisions

Medicare announced recently that the 2026 Medicare deductible will go from $257 in 2025 to $288 in 2026 AND that the Medicare Part B premium before the IRRMA adjustment would increase from $185 in 2025 to $202.90* in 2026. Social Security announced that the COLA for 2026 will be based on an increase of 2.8% and that individuals can now to see the impact on the Social Security portal for individuals.

* Medicare revised the premium for Part B’s standard rate from $206.50 to $202.90 on November 16, 2025.

We’re excited to get to know you!

Come join us at one of our events, subscribe to our newsletter, or reach out via the button below.